Investing doesn’t require a large sum of money to get started. In fact, even with $100, you can begin building your investment portfolio. If you’re wondering how to start investing with $100, you’re not alone. Many beginners are curious about how they can enter the world of investing with a small initial amount. This article will guide you through the steps, the best investment options, and strategies for investing your first $100.

Why Start Investing with $100?

Investing early, even with a small amount, has numerous benefits. The power of compound interest and consistent growth over time can help turn a small investment into something substantial. When you start investing with $100, you’re not just putting money aside, you’re beginning a habit that could lead to long-term wealth accumulation.

How to Start Investing with $100: Key Steps

1. Set Your Financial Goals

Before you start investing your $100, it’s important to know what you’re aiming for. Are you investing for long-term growth, retirement, or a short-term goal like a vacation or a new purchase? Your financial goals will help guide your investment strategy.

Ask Yourself:

- Do I want to invest for retirement (long-term)?

- Am I saving for something specific in the short term (like a home or car)?

- How much risk am I willing to take?

2. Choose the Right Investment Platform

To invest your $100, you’ll need a platform to do so. There are many online brokerages and apps that allow you to start with low amounts. Some of the best platforms for beginners allow you to open an account with as little as $5 or $10, and many have no account minimums. These platforms offer commission-free trading, making it easy and cost-effective to start investing.

Popular Investment Platforms:

- Robinhood – A popular app with zero commissions, ideal for beginners.

- E*TRADE – Offers a wide range of investment products with user-friendly tools.

- Acorns – Invests your spare change automatically into ETFs and other assets.

3. Explore Beginner Investment Options with $100

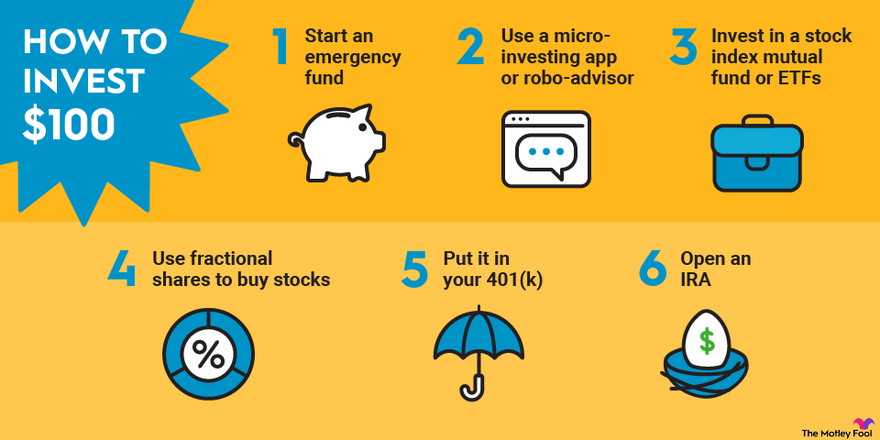

Now that you have your platform, it’s time to look at your beginner investment options with $100. There are several investment opportunities that don’t require a large initial deposit but offer potential for growth.

Top Investment Options:

- Stocks: Investing in individual stocks can be exciting, but it’s important to remember that stock prices can fluctuate. For beginners, it’s often advised to start with companies you know and trust.

- ETFs (Exchange-Traded Funds): ETFs are a collection of stocks, bonds, or other assets bundled into one investment. They allow you to diversify your portfolio without needing a large amount of money. ETFs can be a great way to start investing with $100 as they often have low expense ratios and provide exposure to a wide range of assets.

- Mutual Funds: Similar to ETFs, but managed by professionals. You can start investing in a mutual fund with $100 if the fund has a low minimum investment requirement.

- Robo-Advisors: Robo-advisors are online platforms that automatically invest your money based on your risk tolerance and financial goals. Many robo-advisors have no minimum deposit and charge low fees, making them a great choice for those starting with small amounts.

- Cryptocurrency: If you’re interested in digital currencies, platforms like Coinbase allow you to invest small amounts in cryptocurrencies like Bitcoin, Ethereum, or other altcoins. However, cryptocurrencies can be highly volatile, so it’s important to invest cautiously.

4. How to Invest $100 in Stocks for Beginners

If you want to invest specifically in stocks with your $100, the process is simple but requires careful consideration. Since you’re just starting out, you should focus on building a diversified portfolio, meaning you invest in several companies or sectors to reduce risk.

Steps to Invest $100 in Stocks:

- Research Companies: Look for companies that have a proven track record of growth. For example, consider well-established companies like Apple or Microsoft, which are often considered safer investments.

- Buy Fractional Shares: With $100, you may not have enough to buy a full share of some companies (like Amazon or Tesla). Fortunately, platforms like Robinhood and Charles Schwab offer fractional shares, allowing you to invest as little as $1 in high-priced stocks.

- Diversify Your Investments: Avoid putting all your $100 into one stock. Instead, consider spreading it across multiple companies or sectors. This can help reduce risk and potentially increase your chances of positive returns.

5. Consider Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a strategy where you invest a fixed amount regularly, regardless of market conditions. This strategy is particularly useful for beginners and can be applied even with as little as $100. By investing in small, consistent amounts, you minimize the risk of investing a large sum at the wrong time.

How Dollar-Cost Averaging Works:

- Instead of investing all your $100 at once, you could decide to invest $20 every month.

- Over time, this strategy smooths out the effect of market volatility and ensures that you’re buying into investments at various price points.

6. Monitor Your Investments Regularly

Once you’ve invested your $100, it’s important to monitor your portfolio regularly. While you don’t need to check it every day, keeping an eye on your investments will help you stay on track toward your financial goals.

7. Reinvest Your Earnings

Any dividends or interest you earn from your investments should be reinvested to maximize your returns. Many platforms offer automatic reinvestment options, so you don’t have to worry about manually reinvesting your earnings.

Comparison of Investment Options for $100

| Investment Type | Minimum Investment | Risk Level | Returns Potential |

|---|---|---|---|

| Stocks | $1 (via fractional shares) | High | High |

| ETFs | $50 or less | Moderate | Moderate to High |

| Robo-Advisors | $5 | Low to Moderate | Moderate to High |

| Cryptocurrency | $1 | Very High | Very High |

| Mutual Funds | $100 (for low-minimum funds) | Moderate | Moderate to High |

FAQs: How to Start Investing with $100

1. Can I really start investing with just $100?

- Yes! There are many platforms that allow you to start investing with as little as $5 or $10. With $100, you have enough to diversify your investments and potentially see growth.

2. What is the best way to invest $100 for beginners?

- For beginners, ETFs and robo-advisors are great options, as they allow you to diversify with a small amount of money and have a lower risk than individual stocks.

3. Can I invest $100 in stocks?

- Yes, you can invest $100 in stocks, especially with platforms that offer fractional shares. This allows you to invest in expensive stocks like Amazon or Tesla without needing to buy a full share.

4. How much can I make with $100 invested in stocks?

- The return on investment varies greatly depending on the stock market’s performance. In general, the stock market has historically returned an average of 7-10% per year. However, individual stocks can have higher or lower returns.

5. Is cryptocurrency a good option for $100 investment?

- Cryptocurrencies can offer high returns, but they are highly volatile and risky. If you’re new to investing, it’s best to start small and only invest money you’re willing to lose.

Conclusion

Starting to invest with $100 is not only possible, but it’s a smart way to begin your financial journey. By choosing the right platform and investment options, even beginners can see growth and learn the basics of managing their money. Whether you’re looking to invest in stocks, ETFs, mutual funds, or cryptocurrency, there are plenty of opportunities to make your $100 work for you. Keep learning, stay patient, and you’ll be on your way to becoming a confident investor.